Credit insurance is now an option to Entergy’s commercial and industrial businesses to cover deposits when they open an account with Entergy or modify their existing contract. We’re one of the few utilities in the country where credit insurance is an option.

Companies moving into or expanding in our region are often surprised and glad to find out they have alternatives other than cash or third party guaranties of a surety bond or letter of credit.

This additional deposit option is one of many examples of how Entergy has worked with customers to create new solutions that work best for their business.

Several years ago, an industrial customer negotiating a contract with us on a large expansion requested that they be able to use credit insurance. Though the traditional cash or third-party guaranties were the deposit options Entergy had offered for decades, we were open to finding a new way.

I was on the team that developed the new model for credit insurance as a deposit option and shepherded it through the long process of contract negotiations and modifications. We were successful in working through the complex acceptance process by the jurisdictional regulatory departments in the four states where Entergy operates. Beginning in Aug. 2015, the credit insurance option was opened to large commercial and industrial customers looking for cost effective alternative.

The deposit amount Entergy requires from commercial and industrial customers is calculated at two months of usage level. This deposit is necessary to help manage the risk of nonpayment or bankruptcy.

In the case of large hotels, office buildings, commercial manufacturing and industrial plants, the required deposit amounts can range from tens of thousands into millions of dollars. In the past, when given the choice of third party guaranty or cash, the vast majority of large customers chose the third party guaranty and kept their cash available for operations.

A cash deposit is always an acceptable option that for some businesses is the best choice. Entergy pays interest on these cash deposits in the form of line item credits to the account. The timing of the interest credit and the interest rate are both set by the public service commission in each jurisdiction, so they vary from state to state. The credit is typically posted yearly, and the interest rates may range from .3% to 5.0%.

For a third party guaranty, an Entergy representative determines the required deposit amount, and the customer applies for either a surety bond from their insurance broker or a letter of credit from their banker. In both cases the customer pays a yearly premium for these documents. In addition to the premium, the bank will reduce the customer’s line of credit by the amount of the letter of credit given to Entergy. If a customer has accounts in multiple jurisdictions, separate surety bonds or letters of credit are required for each jurisdiction.

Entergy has a master credit insurance contract with Euler Hermes, one of the largest credit insurance providers underwriting over $2 Billion of trade receivables. All credit insurance inquiries are directed to a specified broker: One Source Risk Management and Funding in Houston.

The approval process usually takes only a couple days. If the application is approved, One Source generates a premium invoice to the customer and sends Entergy the coverage endorsement after the premium is paid. The new customer is added to the credit risk pool as a line-item endorsement under the Euler Hermes – Entergy contract.

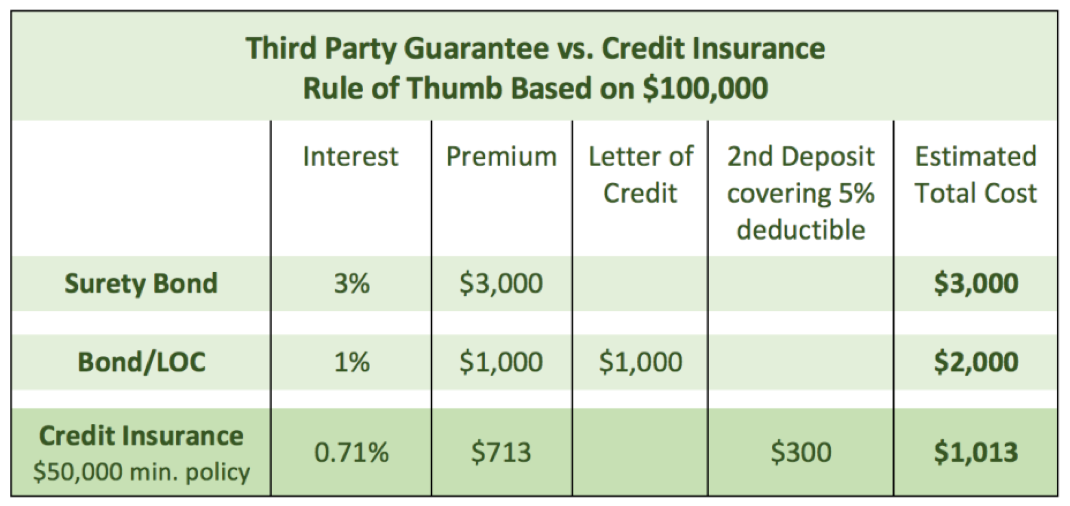

The premium rate billed to Entergy credit-insured customers is based on the credit rating and experience of the risk pool. Currently the premium rate is .7125% or $7,125 for $100,000 of coverage, which can be a substantial savings over the usual premium costs of 1% to 3% for letters of credit or surety bonds.

While the actual premium cost of a surety bond or letter of credit will vary, the credit insurance premium is fixed. This allows the customers to shop their best rate and go with the third party guaranty that best fits their needs.

The table included here is a rule-of-thumb example of potential savings through credit insurance.

Customers need to be aware of the following terms of the Entergy credit insurance option:

While Entergy requires deposits for all accounts, we aim to give customers choices that best meet their business goals. Please contact us if you have questions or want help determining which credit option will work best for your business.